View Photos

Events

January 21 2020

Industry challenges in Canada and in Quebec - Innovative Medicine Canada

Innovative Medicines Canada: we’ve all heard of them, but what exactly do they do? At our January meeting, we covered how IMC is helping their members and Canadian patients through advocacy work with provincial and federal governments and other key stakeholders in the pharmaceutical industry. Our speaker was IMC Director of Quebec, Mr. Frédéric Alberro.

Opening Remarks and Housekeeping - Mary Salib, PMCQ Director

- This was a breakfast meeting.

- Thank you to TANK for doing the creative for this event and Bristol-Myers Squibb for their sponsorship of the event.

- Our next meeting is on Tuesday February 18th and will feature a presentation by Cédric Bisson from Teralys Capital, a private fund manager that finances private venture capital funds in information technologies, life sciences, and clean and industrial innovations. He will discuss future trends in technology in the life sciences sector. Hope to see you there!

Introduction of speaker - Mary Salib, PMCQ Director

This meeting featured a talk by a representative from IMC:

What is IMC? - Frédéric Alberro

- IMC is formerly known as Rx&D and represents more than 40 pharmaceutical companies in Canada, most of which are global companies.

- Mission: As the voice of research-based pharmaceutical companies, IMC promotes and supports policies that enable the discovery, development and commercialization of innovative medicines and vaccines that enhance the lives of all Canadians.

- Notable board members:

- Dr. Philippe Couillard used to lead the health research fund.

- The new Chair of the board is the CEO of Roche Canada Ronnie Miller.

- The President is Pamela Fralick, who has previously led several health and patient groups in Canada.

- Mr. Alberro is in charge of the team in Québec.

- IMC is on social media; feel free to follow!

- Note about changes to the Code of Ethical Practices: The updated IMC Code came into effect on January 1, 2020; however, and to facilitate an orderly transition from the current rules, the changes related to Patient Support Programs and Medical Practices Activities will come into effect on July 1, 2020, while those related to sponsoring third-party conferences and congresses will come into effect on January 1, 2021.

The 4 Ps of Governmental Relations

- Positioning: Establishing clear demands and policies

- Promotion: Identifying key strategic stakeholders

- Partnership: Working with all of the stakeholders

- Patience: Waiting until the best policy is developed (it can take a long time to receive concrete results in public policy)

IMC’s Challenges

- Main challenges:

- Reputation: Maintaining the pharmaceutical industry’s reputation through good public relations

- Compliance: Ensuring members are compliant to the association’s standards by following the Code of Ethical Practices

- The Ecosystem: Forging strong relationships with stakeholders by listening to what they have to say

- The IMC will meet with anybody who has something to say about the industry; for example, meeting with unions or insurance companies.

- Market Access: Advocating on behalf of the industry when it comes to cost-containment measures

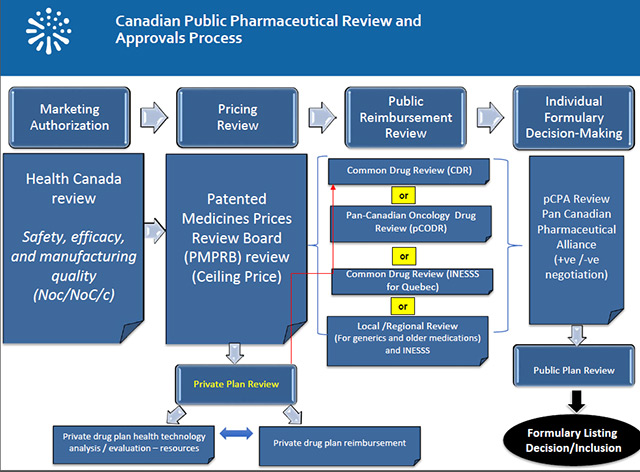

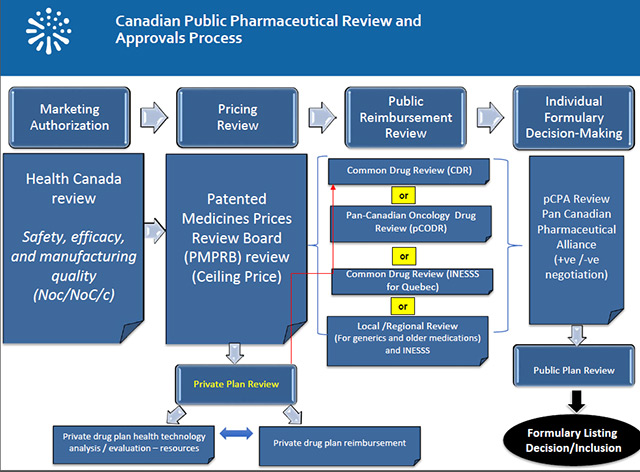

- This is a major challenge that is outlined in more detail below. You can also refer to Mr. Alberro’s slides found here.

- IMC is involved with stakeholders such as PMPRB, CADTH, INESSS and the pCPA.

- Challenges in market access:

The changes announced in August 2019 to the Patented Medicines Regulations which govern the Patented Medicine Prices Review Board (PMPRB) and which will take effect on July 1, will limit Canadian patients' access to new innovative drugs and discourage investments in the Canadian life sciences sector, including clinical trials.

The case studies of PMPRB indicate that the amended Regulations will lower the ceiling price of drugs by 70%, weakening the cost-benefit analysis for launching new drugs in Canada. A recent EY study confirms that there is indeed a correlation between market conditions for global drug launch decisions.

According to a report by PDCI based on the Regulations project, the estimated loss of revenue for the Canadian biopharmaceutical industry is $ 18.5 billion. This is more than double the impact estimated by the federal government.

IMC and its member companies, as well as dozens of stakeholders - including provincial governments like Quebec, have repeatedly asked the government to review its approach.

Despite assurances from PMPRB representatives that the Guidelines would provide clarity and show that the new regulatory framework would not be as damaging as originally believed, a review of the guidelines published on November 21 mentions the opposite.

IMC calls urgently for the immediate suspension and reassessment of regulatory changes to the PMPRB through real and wide-ranging public and transparent consultation (similar to that obtained in Australia and England when there were similar reforms).

Innovative Medicines Canada (MNC) and 16 of its member companies have applied to the Federal Court of Canada for judicial review of the published amendments that the federal government does not have the power to fundamentally change the role of the PMPRB through recent changes.

Five (5) of our members have filed a legal contestation on the constitutional aspect of the PMPRB reform. The Canadian Cystic Fibrosis Treatment Society added to this remedy.

- A major issue is the number of drugs listed.

- Across OECD countries, 70% of drugs are listed, and this is consistently true in Québec and Ontario; in other provinces, however, only 39% of drugs are listed.

- Another issue is the time to access.

- When Québec joined the pCPA, it increased the time to access.

- The number one issue for IMC right now is the PMPRB reforms.

- IMC is trying to advise the federal government on the reforms, but the Health Minister seems to be underestimating the impact of the changes.

- The reforms could impact clinical trial access in Canada because if there is a low chance of accessing a drug after the clinical trial then why would a company fund a clinical trial in Canada?

- There are currently legal challenges between some of the provinces and the federal government on the constitutionality of the reforms.

- IMC is also engaged with the private sector to maintain dialogue about drug access.

- There is consensus on some issues, but not on others. (For example, the private sector is in favour of the PMPRB reforms.)

- Private drug costs are 3.5% per year with an increase of 4.2% per year.

- 75% of this increase is not actually due to the cost of the drugs, but to the increase in utilization.

- Pharmacist fees are 22% and insurance charges are 20% of drug costs; if employers are worried about drug costs, they should have discussions with their insurers to discuss the insurance charges.

- IMC advocates for a value-based health system so that payers can have data and make informed decisions.

- IMC also believes we need to find a better, multidisciplinary way to manage chronic conditions.

- Regarding high-cost therapies, IMC has a rare disease model/strategy to propose to provincial governments.

- BC and Alberta have implemented biosimilar policies that will restrict access to biologic drugs. A similar policy may soon come to Ontario. IMC is having discussions with the CAQ government, but Mr. Alberro could not say more about that at the time of the meeting.

- On the topic of a national pharmacare plan, Mr. Alberro suggested viewing this as an opportunity for the industry.

- It’s normal that people in society will have questions.

- People like to point out that Canada is the only country that does not have national pharmacare, but they just need to be informed that drug coverage is decided by the provinces; not at the federal level.

- There is a lot of advocacy to the Trudeau government.

- The Conservatives are not as vocal on this issue.

- Bloc Québecois made their position very clear, which is that Québec already has a good model and wants compensation if Canada initiates a national pharmacare plan.

- Many people are advocating for a national pharmacare plan similar to Québec’s plan, but many are also opposed to it because it is a mixed system and some groups want to have a totally public system.

- IMC believes Canada should have a mixed system that allows private plans in addition to a national pharmacare plan.

- IMC warns against a fully public payer system because there are some countries that have fully public plans but these countries also have 50% out-of-pocket costs. Almost 2% of Canadians do not have coverage and 10% of people are eligible for public drug coverage but are not enrolled. 0.5% of people do not take their drugs as prescribed because of cost. It is important to understand these barriers to access before converting to a fully public payer system.

- Many people are happy with their private plans, which is another reason to consider a mixed payer system.

- IMC’s position is that every Canadian should have access to drugs. This means that the plan should be flexible because there are innovative medicines coming to the market soon, such as gene therapy, CAR-T cell therapy, etc.

- Quebec has a good system, but there is room for improvement.

The Industry’s Value

- Pharmaceuticals have had a positive impact on the health system.

- An example is the significantly improved mortality rates with some of the new oncology drugs.

- The IMC continues to work to maintain good public relations by sharing this point.

- The industry has also had a positive economic impact.

- Pharma is the 3rd largest R & D industry in Canada and 50% of company headquarters are in Québec.

- Only about 20% of headquarters are in Québec for other sectors.

Facts About Drug Costs

- Canada’s per capita expense on drugs is consistent with the average for OECD countries.

- Patent drug costs are 6.9% of total healthcare costs and the growth of these costs is 2.3%; other healthcare costs are growing much more quickly.

- For many years, drug cost growth was lower than inflation.

Questions

Q: What has been the most significant thing you learned working for the Quebec government in the past, and how has this impacted what you do now?

A: They always want to compare how Québec is doing compared to other provinces in terms of investments, programs, etc. This is still true today and they are assessing how their drug coverage plan is doing compared to other provinces.

Q: Considering a minority government, how are we working with opposition to shape the PMPRB reform?

A: IMC is engaging with the other parties. Bloc Québecois’s position is quite reasonable. The Conservative Party is dealing with their leadership issue right now, but part of IMC’s strategy is to be engaged with them.

Q: Do government bodies consider the length of time and repetition of analysis of the same data when negotiating drug prices? Would streamlining reviews help achieve economic aid?

A: Yes, streamlining reviews could help. IMC is having discussions to work towards reducing the time to list drugs, but at same time, there are the PMPRB reforms and national pharmacare discussions happening.

Justine Garner

Freelance Medical Writer

Cell: 514-605-5109

Email: jgarnerwriting@gmail.com

www.jgarnerwriting.com